Limited Liability Partnership Registration - Online Procedure, Documents Required, Cost

Limited Liability Partnership (LLP) is an upgraded form of Partnership, which has limited liability

features of a Private Limited Company and the flexibility of a Partnership firm. The maintenance

cost of an LLP and simplicity in formation is one of the prime reasons why it has become a preferred

choice for entity incorporation. You can easily commence your business by incorporating an LLP and

get the combined benefit of a limited company as well as a partnership firm. Read more to know the

process, documents required, and fees of LLP registration.

What is LLP Registration?

LLP is a form of partnership that is registered under the Limited Liability Partnership Act, 2008

where liabilities of all the partners are limited to the extent of contribution bought by them. It

helps owners to limit their liabilities while enjoying the advantages of a limited company which is

an edge over a traditional partnership firm.

No partner is liable on account of unauthorized actions of other partners, thus individual partners

can safeguard them from joint liability arising from misconduct of other partners. LLP as an

organization is mostly preferred by professionals, micro and small businesses.

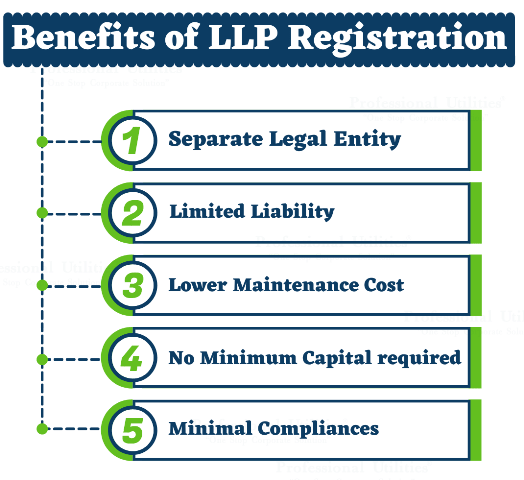

Benefits of LLP Registration

- Separate Legal Entity: An LLP is a separate legal entity from its partners. It is a major

advantage that is not available for normal partnerships.

- Limited Liability: It helps in protecting the personal assets of the owners with limited

liability protection.

- Lower Cost: The cost of registering an LLP is comparatively lower than a private limited

as well as a public limited company.

- No Minimum Capital Required: An LLP can be formed with the least amount of capital as

there is no minimum capital requirement for incorporating an LLP.

- Minimal Compliances: One of the key benefits of registering an LLP is lower compliance

requirements. Mandatory criteria for annual compliances of an LLP are on the lower side as when

turnover is less than 40 lakhs, LLP audit is optional.

Checklist for LLP Registration

There are certain minimum requirements for LLP registration that need to be met. Here's the quick

checklist:

- Minimum two partners

- At least one partner should be a resident of India

- DPIN for all designated partners

- DSC for all designated partners

- Each partner has to contribute towards the capital of LLP

- Address proof for the office of LLP

LLP Registration Process

- Step 1: Reserve Your LLP Name

LLP RUN (Limited Liability Partnership-Reserve Unique

Name) form is filed for reservation of proposed name. While making the name application, it is

recommended that the name should not be similar, identical or phonetically similar to existing

companies, firms, LLPs, and trademarks. You can easily check the name availability by using our

LLP name search tool or company name search tool. If it fulfills all the prerequisites, the

proposed name is approved by the Central Registration Center of the Ministry of Corporate

Affairs if found in ordinance.

Note: It should be ensured that the business name does not

resemble the name of any other already registered company and also does not violate the

provisions of emblems and names (Prevention of Improper Use Act, 1950).

- Step 2: Obtain Digital Signature Certificate

Limited Liability Partnership

incorporation is a completely digital process and therefore the requirement of a Digital

Signature Certificate is a mandatory criterion. All the designated partners of the proposed LLP

need to apply for a DSC from the certified agencies. Obtaining a DSC is a completely online

process and it can be done within 24 hours. This process involves 3 simple verifications that

are document verification, video verification, and phone verification.

- Step 3: Application for LLP

FiLLip form has to be filed with the registrar of

companies for incorporation of Limited Liability Partnership. Details which has to be filed in

the FiLLip form are:

- Address of the registered office

- ROC

- Business activity code

- Number of designated partners and partners

- Personal details of designated partners and partners

- Contribution of designated partners and partners

- Certification by a professional (CA, CS, CMA)

- Step 4: Issuance of COI (Certificate of Incorporation)

Post-approval of FiLLip form,

Certificate of Incorporation is issued in form 16 from Central Registration Center of MCA under

the letterhead of Government of India. LLP identification number is a part of the certificate of

incorporation.

- Step 5: Drafting & Filing of LLP Agreement

LLP Agreement is the most important

document of an LLP that governs the mutual rights and duties of the partners; between the LLP &

its partners. Drafting and filing of stamped LLP Agreement have to be made within 30 days from

the date of issuance of incorporation certificate. Application for filing of LLP Agreement is

made under Form 3 online on MCA portal. Failing to do so would attract penal provisions of the

LLP Act, 2008.

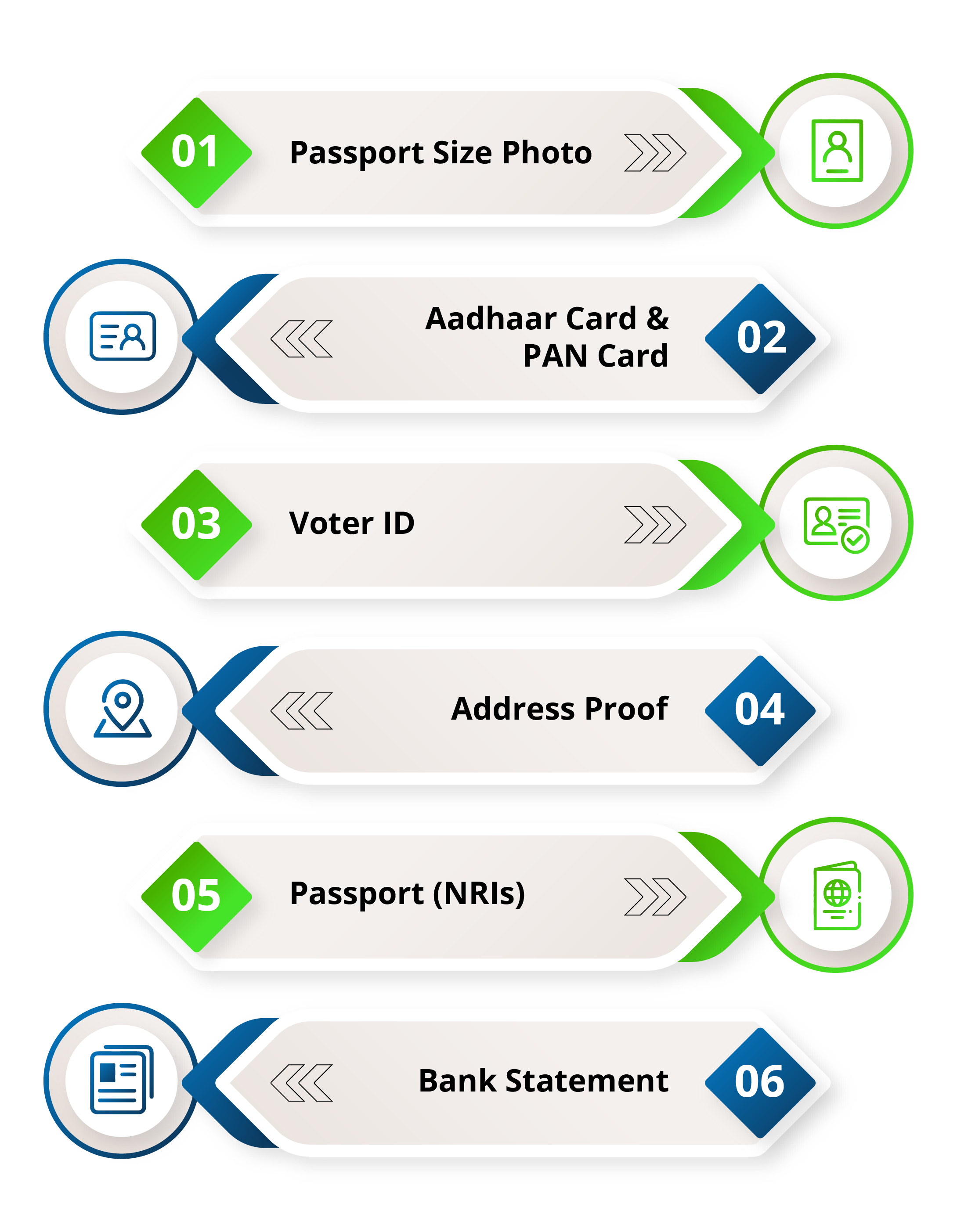

Documents Required for LLP Registration

As per the Limited Liability Partnership Act 2008, you are required to provide proper identity proof

of partners and address proof of office for LLP registration.

Documents of Partners

- Passport size photographs of all partners

- Copy of PAN Card of all Partners

- Copy of Aadhar Card

- Passport (in case of Foreign Nationals or NRIs)

- Copy of Driving License or Voter ID

- Bank statement (not older than two months)

Documents of Registered Office

- Electricity Bill or any other utility bill for the address proof

- If it is a rented property, a No Objection Certificate from the owner of the property is

required

Documents You’ll Get After LLP Registration

- Certificate of Incorporation

- LLP Agreement

- FiLLip Form

- Form-3

- LLP PAN

- LLP TAN

- Payment Challan

- Company Master data

- DSC and DPIN for designated partners

Packages

Basic LLP

₹7999

Plus taxes

- LLP Incorporation Certificate

- Drafting and Filing of LLP Agreement

- 2 DIN, PAN & TAN

- Current Bank Account*

- 1 Partner DSC

LET'S START

Standard LLP

₹9499

Plus taxes

- LLP Incorporation Certificate

- Drafting and Filing of LLP Agreement

- 2 DIN, PAN & TAN

- Current Bank Account*

- 1 Partner DSC

- GST Registration

LET'S START

Premium LLP

₹13499

Plus taxes

- LLP Incorporation Certificate

- Drafting and Filing of LLP Agreement

- 2 DIN, PAN & TAN

- Current Bank Account*

- 1 Partner DSC

- GST Registration

- GST Invoice Software (1-Year Validity)

- Business Website

LET'S START

Frequently Asked Questions (FAQ)

Limited Liability Partnership is a hybrid of partnership firm and private limited

company. It has the features of limited company and flexibility of partnership.

You can arrange the required documents and fulfill all the requirements as per Limited

Liability Partnership Act, 2008. You can opt for professional service easily from Legal

Papers India as we simplify the registration process for you.

Yes, if you want to run a business legally with your partners then you have to

incorporate LLP. Otherwise, it would not be considered a registered firm until you get

incorporation certificate from MCA and approval of LLP agreement from the Government of

India.

No, GST is not required for LLP registration.

LLP and Pvt Ltd Company both have their own pros and cons. It completely depends upon

the requirement of the business.

LLP Annual filing includes following components: Annual Return Statement of the Accounts

or you can say Financial Statements of the LLP Income Tax Returns Filings.