One Person Company (OPC) Registration - Online Process, Documents Required, Cost

One Person Company (OPC) is a type of private limited company which can be formed with just one

person who will act as director and shareholder of the company. The need for one person company

arose due to the limitations of sole proprietorship firm which is the most popular form of business

registration for small businesses in India. Unlike private limited company or an LLP where at least

2 people are required, entrepreneurs can now incorporate their company with one person only.

What is a One Person Company?

One Person Company or "OPC" is a kind of private limited company which is registered under the

Companies Act, 2013. It can be registered with a single person who acts both as the director as well

as shareholder of the company. OPC company use "opc private limited" or "opc pvt ltd" at the end of

their company name because it is a private company owned by a single person.

Earlier in a private limited company, a minimum of 2 directors and 2 members were required. A single

person could not form a private company. But a new concept of OPC was introduced as per Section

2(62) in the Company's Act 2013 where a single person can form a private limited company.

Benefits of One Person Company Registration

- Limited Liability: It helps in protecting personal assets of the owners with limited

liability protection. So if there are any financial issues with the company, the assets of the

director are secured and could not be seized by banks or departments.

- Credibility: As OPC is a private limited company, it has higher credibility than

traditional proprietorship firms. Unlike Sole Proprietorship, the Certificate of Incorporation

is issued to One Person Company.

- Continuous Existence: Unlike proprietorship, where the firm comes to an end with any

mishappening with the proprietor, One Person Company continues to exist as it is passed on to

the nominee director.

- Separate Legal Entity: An OPC is a private legal entity in its own right and hence the

business owners aren't subject to any personal liability. The company can acquire assets and

incur debts on its own name.

- NRIs can register OPC: As per the amendment in the Union Budget 2021-22, One Person

Companies can be incorporated by non-resident Indians. A person who has stayed in India for a

minimum period of 120 days immediately preceding the financial year can register an OPC.

Process of One Person Company Registration

- Step 1: Application for Digital Signature Certificate (DSC)

One person company

incorporation is a complete digital process and therefore requirement of Digital Signature

Certificate is a mandatory criteria. The person who would act as director and subscriber to the

memorandum of the company needs to apply for a DSC from the certified agencies. Obtaining a DSC

is a complete online process and it can be done within 24 hours. This process involves 3 simple

verifications that are document verification, video verification and phone verification.

- Step 2: Application for the Name Approval

Name application for one person company can

be done through SPICe RUN form which is a part of SPICe+ form. While making the name application

of the company, industrial activity code as well as object clause of the company has to be

defined.

Note: It should be ensured that business name does not resemble the name of any

other already registered company and also does not violate the provisions of emblems and

names (Prevention of Improper Use Act, 1950). You can easily check the name availability by

using our company name search tool to verify the same.

- Step 3: Filing of SPICe Form (INC-32)

Post name approval, details with respect to

registration of the company has to be drafted in the SPICe+ form. It is a simplified proforma

for incorporating a company electronically. The details in the form are as follows:

- Details of the company

- Details of the member and subscriber

- Application for Director Identification Number (DIN)

- Application for PAN and TAN

- Declaration by director and subscriber

- Declaration & certification by professional

- Step 4: Filing of e-MoA (INC-33) and e-AoA (INC-34)

SPICe e-MoA and e-AoA are the

linked forms which have to be drafted at the time of application for company registration.

Memorandum of Association (MOA) is defined under section 2(56) of the Companies Act 2013. It is

the foundation on which the company is built. It defines the constitution, powers and objects of

the company. The Articles of Association (AOA) is defined under section 2(5) of the Companies

Act. It details all the rules and regulations relating to the management of the company.

- Step 5: Issuance of PAN, TAN & Certificate of Incorporation

Post approval of the above

mentioned documents from the Ministry of Corporate Affairs; PAN, TAN & Certificate of

Incorporation will be issued from the concerned department. Now, the company is required to open

a current bank account by using these documents. You can contact us for assistance with your

current bank account opening.

Register your OPC in India with Legal Papers India

The process of registering a One Person Company is complicated and involves various compliances. Our

experts at Legal Papers India can simplify the whole registration process for you. Register your OPC

online in 3 easy steps:

- Fast Process in Record Breaking Time

- Experienced Expert

- No Hidden Charges

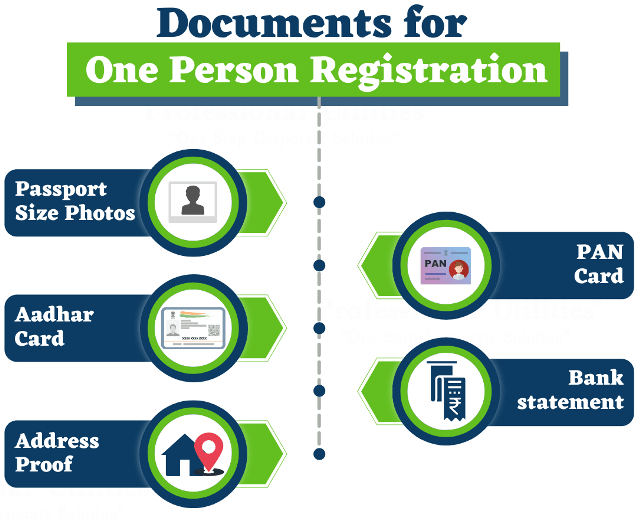

Documents Required for One Person Company Registration

For incorporating your business as a One Person Company, you need to provide proper identity and

address proof. The documents are required to be submitted to the Registrar of Companies.

- Passport size photographs

- Copy of Aadhar Card or Voter ID

- Copy of PAN Card

- Copy of Bank Statement (not older than two months)

- Valid address proof of office which can be the latest electricity or any other utility bill

- If it is a rented office, then No Objection Certificate is required from the owner of the

property

Documents You'll Get After OPC Registration

- Certificate of Incorporation

- Permanent Account Number (PAN) of the company

- Tax Deduction or Collection Account Number (TAN) of the company

- Articles of Association (AoA)

- Memorandum of Association (MoA)

- Director Identification Number (DIN)

- Digital Signature Certificate (DSC)

- EPF and ESIC registration documents

- Company Master data

Packages

Basic

₹5199

Plus taxes

- Company Name Approval

- Certificate of Incorporation

- Current Bank Account*

- PAN

- TAN

- 1 DIN

- eMOA

- eAOA

- (1 Indian Director, 1 Shareholder and Authorised Capital of Rs. 1,00,000)

LET'S START

Standard

₹7199

Plus taxes

- Company Name Approval

- Certificate Of Incorporation

- Commencement of Business

- Current Bank Account*

- PAN

- TAN

- 1 DIN

- eMOA

- eAOA

- PF Registration

- ESI Registration

- GST Registration

- GST Invoice Software

- Documentation Kit

- (1 Indian Director, 1 Shareholder and Authorised Capital of Rs. 1,00,000)

LET'S START

Premium

₹11199

Plus taxes

- Company Name Approval

- Certificate Of Incorporation

- Commencement of Business

- Current Bank Account*

- PAN

- TAN

- 1 DIN

- eMOA

- eAOA

- PF Registration

- ESI Registration

- GST Registration

- GST Invoice Software

- Documentation Kit

- Website**

- Online Payment Gateway

- (1 Indian Director, 1 Shareholder and Authorised Capital of Rs. 1,00,000)

LET'S START

Frequently Asked Questions (FAQ)

You can either register a Proprietorship Firm or a One Person Company. After choosing

the entity type, you'll need to provide proper documents and proofs along with

professional certifications to MCA portal.

Yes, a single person can form a company by registering a one person company or sole

proprietorship. The type of business entity will depend on the business requirements.

A single person can form a private limited company and enjoy all the benefits of Pvt Ltd

Company. Some of the main benefits are limited liability, separate legal entity,

credibility and tax benefits.

Yes, an OPC can be easily converted into Pvt Ltd company.