Pvt Ltd Company Registration in India - Online Process, Fees, Documents Required

Private Limited Company is the easiest and most authentic way of company incorporation in India. Most

people choose this form of business registration because of its beneficial features like limited

liability and separate legal entity for its shareholders and directors. More than 90% of registered

companies in India are Private Limited Companies. It is the most popular form of company

registration as it provides reputation and credibility to the business in the market. Get to know

the process, fees, and requirements of Pvt. Ltd. registration.

What is a Private Limited Company?

A private limited company is a type of business entity that a small group of people privately and

collectively holds. It is incorporated under the Ministry of Corporate Affairs. This type of

business entity offers limited liability for its shareholders, and shares can only be traded

privately. It has a minimum of 2 members and a maximum of 200 members. Shareholders are considered

as the owners of the company, whereas directors are considered to be the key managerial persons

(KMP) of the company, while in an LLP, partners are the owners as well as KMPs of the company.

Incorporating a Private Limited Company is the right choice, as it facilitates taxation benefits,

credibility, business expansion, and quicker sanction of business loans. It promotes the easy way

for capital formation and pooling of funds through members.

Benefits of Private Limited Company Registration

- Improves Credibility: Private Company improves credibility by being registered as a

corporate entity.

- Attract Funding: Syndicate both equity and debt funds to have an optimal capital

structure.

- Foreign Investment: Business may attract foreign direct investment (FDI) under the

automatic route.

- Separate Legal Entity: A Private Limited Company is a legal entity in its own right,

allowing the business owner to keep their assets separate from the business itself. This means

that the business owners aren't subject to any personal liability.

- Easy Exit Plan: It has an Exit plan through sale or dilution of equity of the Company.

- Limited Liability: It helps in protecting personal assets of the owners with limited

liability protection.

- Easy Transferability: Ownership of a business can be easily transferred in a company by

transferring shares.

Private Limited Company Registration Process

- Step 1: Application for Digital Signature Certificate (DSC)

Private Limited company

incorporation is a complete digital process and therefore requirement of Digital Signature

Certificate is a mandatory criteria. Directors as well as subscribers to the memorandum of the

company need to apply for a DSC from the certified agencies. Obtaining a DSC is a complete

online process and it can be done within 24 hours. This process involves 3 simple verifications

that are document verification, video verification and phone verification.

- Step 2: Application for the Name Availability

Name application for private limited

company can be done through SPICe RUN form which is a part of SPICe+ form. While making name

application of the company industrial activity code as well as object clause of the company has

to be defined.

Note: It should be ensured that business name does not resemble the name of

any other already registered company and also does not violate the provisions of emblems and

names (Prevention of Improper Use Act, 1950). You can easily check the name availability by

using our company name search tool to verify the same.

- Step 3: Filing of SPICe Form (INC-32)

Post name approval, details with respect to

registration of the company has to be drafted in the SPICe+ form. It is a simplified proforma

for incorporating a company electronically. The details in the form are as follows:

- Details of the company

- Details of members and subscribers

- Application for Director Identification Number (DIN)

- Application for PAN and TAN

- Declaration by directors and subscribers

- Declaration & certification by professional

- Step 4: Filing of e-MoA (INC-33) and e-AoA (INC-34)

SPICe e-MoA and e-AoA are the

linked forms which have to be drafted at the time of application for company

registration.

Memorandum of Association (MOA) is defined under section 2(56) of the Companies

Act 2013. It is the foundation on which the company is built. It defines the constitution,

powers and objects of the company.

The Articles of Association (AOA) is defined under section

2(5) of the Companies Act. It details all the rules and regulations relating to the management

of the company.

- Step 5: Issuance of PAN, TAN & Certificate of Incorporation

Post approval of the above

mentioned documents from the Ministry of Corporate Affairs; PAN, TAN & Certificate of

Incorporation will be issued from the concerned department. Now, the company is required to open

a current bank account by using these documents. You can contact us for assistance with your

current bank account opening.

Register your Private Limited Company Online with Legal Papers India

The process of registering your company as a Private Limited Company is complicated and involves

various compliances. Our experts at Legal Papers India can simplify the whole registration process

for you. Register your company online in 3 easy steps:

- Fast Process in Record Breaking Time

- Experienced Expert

- No Hidden Charges

Minimum Requirements of Pvt Ltd Company Registration

As per the Companies Act 2013, there are minimum requirements that need to be

met for company incorporation online.

At least one director should be the resident of India

Registered office address

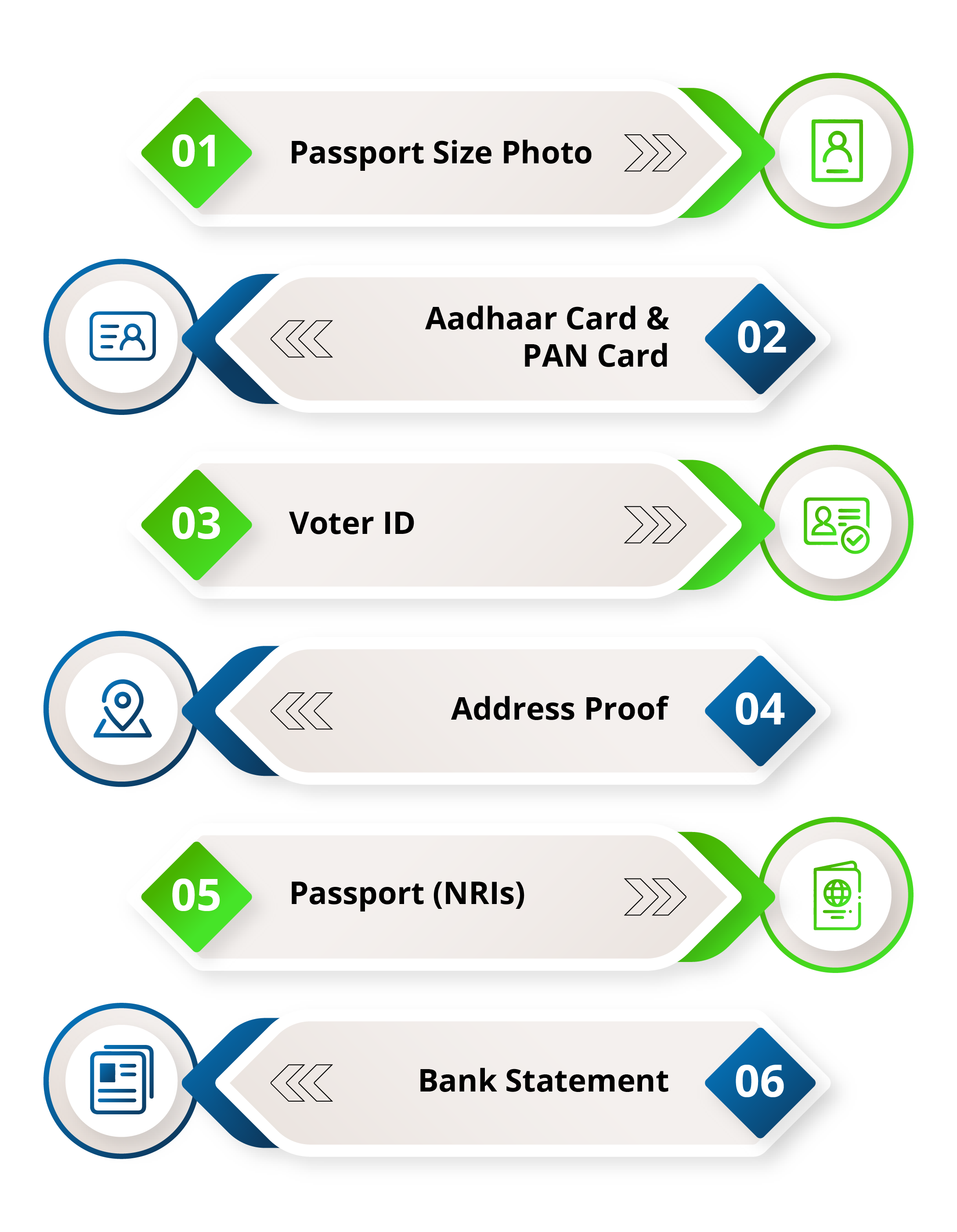

Documents Required for Registration of Private Limited Company

In order to register your private limited company in India, you need to provide proper identity and

address proof. These documents are required for directors and shareholders of the company which will

be submitted to the Ministry of Corporate Affairs (MCA) portal.

Identity and Address Proof of Directors & Shareholders

- Passport size photographs of the directors

- Copy of Aadhar Card

- Copy of Driving License or Voter ID

- Copy of PAN Card

- Copy of bank statement or utility bill (not older than two months)

- Copy of Passport (in case of foreign national or NRI)

Address Proof of Registered Office

- Copy of electricity or any other utility bill (not older than two months)

- Rent agreement (if rented)

- No Objection Certificate (NOC) from the owner of the property

Note: It is not mandatory to own a commercial business premise for incorporation. One can use

their home address proof for registration of the company.

Post-Incorporation Documents You Receive

- Certificate of Incorporation

- Permanent Account Number (PAN) of the company

- Tax Deduction or Collection Account Number (TAN) of the company

- Articles of Association (AoA)

- Memorandum of Association (MoA)

- Director Identification Number (DIN)

- Digital Signature Certificate (DSC)

- EPF and ESIC registration documents

- Company Master data

Comparison

| Feature |

Limited Liability Partnership |

Partnership Firm |

Proprietorship Firm |

Private Limited Company |

One Person Company |

| Act |

Limited Liability Partnership Act, 2008 |

Indian Partnership Act, 1932 |

No specified Act |

Companies Act, 2013 |

Companies Act, 2013 |

| Registration Requirement |

Mandatory |

Optional |

No |

Mandatory |

Mandatory |

| Number of Members |

2 – Unlimited |

2 – 50 |

Only 1 |

2 – 200 |

Only 1 |

| Number of Director/Partner |

2 – Unlimited |

2 – Unlimited |

Only 1 |

2 – 15 |

Only 1 |

| Separate Legal Entity |

Yes |

No |

No |

Yes |

Yes |

| Liability Protection |

Limited |

Unlimited |

Unlimited |

Limited |

Limited |

| Statutory Audit |

Dependent |

Not mandatory |

Not mandatory |

Mandatory |

Mandatory |

| Ownership Transferability |

Yes |

No |

No |

Yes |

No |

| Uninterrupted Existence |

Yes |

No |

No |

Yes |

Yes |

| Foreign Participation |

Allowed |

Not Allowed |

Not Allowed |

Allowed |

Not Allowed |

| Tax Rates |

High |

High |

Low |

Moderate |

Moderate |

| Statutory Compliance |

Moderate |

Less |

Less |

High |

Moderate |

Packages

Basic

₹5999

Plus taxes

- Company Name Approval

- Certificate of Incorporation

- Current Bank Account*

- PAN

- TAN

- 2 DIN

- eMOA

- eAOA

- (2 Indian Directors, 2 Shareholders and Authorised Capital of Rs. 1,00,000)

LET'S START

Standard

₹7999

Plus taxes

- Company Name Approval

- Certificate of Incorporation

- Commencement of Business

- Current Bank Account*

- PAN

- TAN

- 2 DIN

- eMOA

- eAOA

- PF Registration

- ESI Registration

- GST Registration

- GST Invoice Software

- Documentation Kit

LET'S START

Premium

₹11999

Plus taxes

- Company Name Approval

- Certificate of Incorporation

- Commencement of Business

- Current Bank Account*

- PAN

- TAN

- 2 DIN

- eMOA

- eAOA

- PF Registration

- ESI Registration

- GST Registration

- GST Invoice Software

- Documentation Kit

- Website**

- Online Payment Gateway

- (2 Indian Directors, 2 Shareholders, and Authorised Capital of Rs. 1,00,000)

LET'S START

Frequently Asked Questions (FAQ)

You can easily register your private limited company by arranging all the required

documents and fulfilling the requirements as per the Companies Act, 2013.

In order to register your private limited company in India, you need to provide identity

and address proof of all the members along with address proof of the registered office.

Note: You don't need a commercial place for registration, you can use your residential

home address for incorporation.

No, GST is not mandatory for private limited companies.

There is no minimum capital requirement for private limited company registration. One

can start a company with a share capital of as low as ₹10.

LLP and Pvt Ltd Company both have their own pros and cons. It completely depends upon

the requirement of the business.

Yes. A Limited Liability Partnership can be converted into a private limited company

easily. To read more, refer to this page on LLP registration.