Ensure timely and accurate TDS return filing with Aone Filing’s expert services. We help businesses and individuals comply with the Income Tax Act, 1961, by managing TDS obligations efficiently.

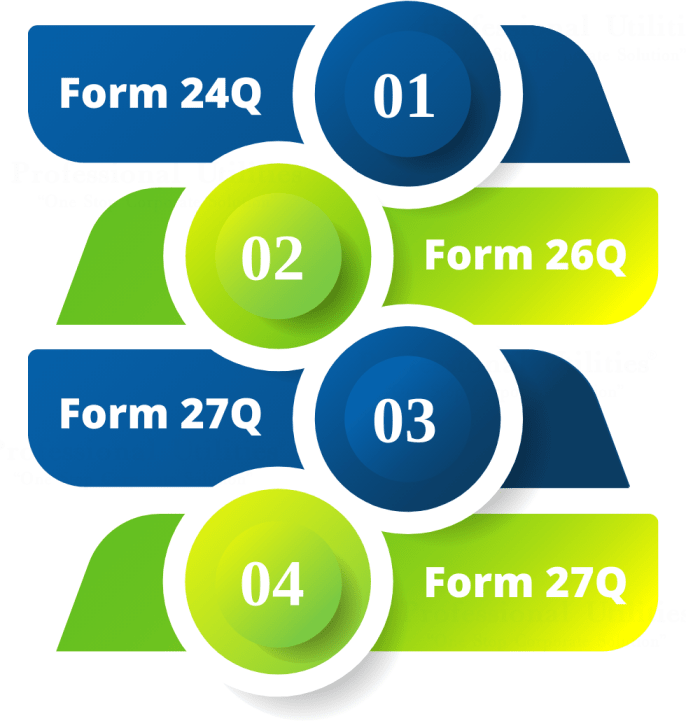

TDS (Tax Deducted at Source) return filing is the process of submitting quarterly statements to the Income Tax Department, detailing the tax deducted from payments such as salaries, rent, professional fees, or interest, as mandated under the Income Tax Act, 1961.

Ensures error-free TDS calculations and filings.

Adheres to the latest TDS regulations and deadlines.

Submits returns before quarterly deadlines to avoid penalties.

Manages complex TDS calculations and documentation for you.

Personalized support from tax experts for TDS compliance.

₹ 1,499 + Taxes

₹ 2,499 + Taxes

₹ 5,999 + Taxes